The purpose of this article series is to show you why you should control your finances and then how to do it using AlphaManager.

Part 1 : Why control your finances?

Part 2 (you are here) : How to manage your finances efficiently with AlphaManager

How to manage your finances efficiently with AlphaManager

First of all know that you cannot control what you cannot measure . So before you can control your finances you need to be able to measure them.

The goal of financial management is to control these and keep them below your income. This allows you to generate savings and then use this savings to make you happy, to deal with the unexpected, invest . It also saves you from being without money and being forced to borrow.

For this you must rigorously record your finances and thus have an accurate view of your money. This will allow you to quickly know how much you are spending per month. The categories where you spend the most money.

When you know where your money goes, you will move on to the second phase, control through budgeting and especially the regular monitoring of these budgets.

And then the third phase build up your savings.

And finally start investing and enjoying yourself without constantly having to think about how to find the money.

The basics :

First, here are some important things to know :

Money entrance or income : It is generally your salary. It can also be the interest generated by your savings, the income from the sale of something. In short, everything that increases the money you have.

Les sorties d'argent ou dépenses : Cela correspond à chaque opération ou vous perdez de l'argent. Des achats, des aides, des frais de compte etc.

Expenses : This corresponds to each transaction or you lose money. Purchases, help, account fees etc.

A wallet : A wallet is anything that can hold money. It could be a bank account, a place where you used to keep money at home. A "tontine" for those who live in Africa. A credit card can also be represented by a wallet. Just like a prepaid card. Be careful a debit card ie a card that allows you to withdraw money in an account is not a wallet.

In AlphaManager the wallets are accessible via the side menu

(at the home, touch the icon at the top left)

in

"Your wallets" .

Categories : Each expense or money entry belongs to a category. For example, your rent is an expense that belongs to the "Housing" category. These categories allow you to organize your expenses and income and to know the purpose or the origin. Thanks to the categories you will know for example where goes the most the bulk of your expenses.

In AlphaManager the categories are accessible via the side menu

(at the home, touch the icon at the top left)

in

"Categories" .

AlphaManager comes with several categories created by default. You can create new ones, make changes etc. For each category, you can associate a color and an icon (optional). You can also associate a budget with a category. This will be used to set your budget by category.

During installation, AlphaManager creates a single wallet. It represents the money you have on you, Hence its name "Wallet". You can then create as many wallets as you want. For each wallet, you can associate a color and an icon (optional). You can also define the wallet as of your savings, which will allow you to follow the evolution of this one.

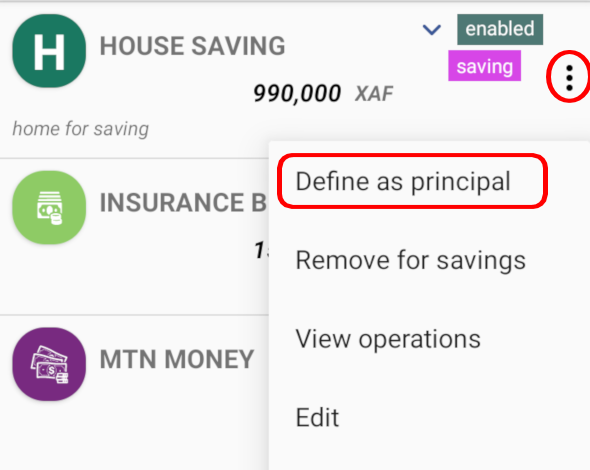

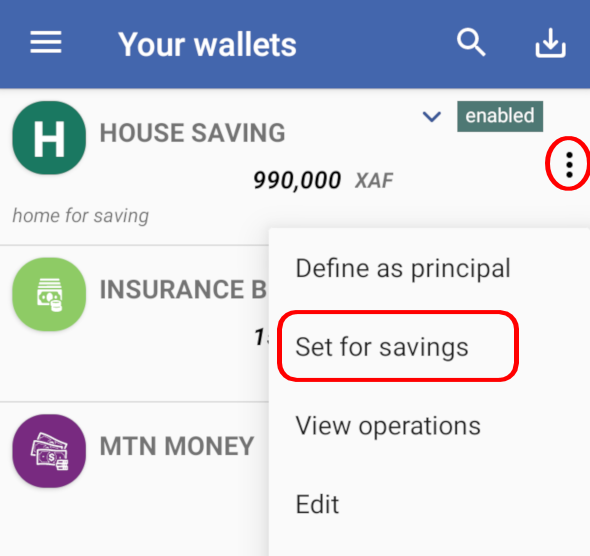

When you record an expense, a wallet is selected. It's the main wallet. You can change this by going to "Your wallets" in the side menu. Touch the three dots to the right of the wallet and take "Set as primary".

The use of AlphaManager :

Your daily activity will be to note in the application your income and your expenses while taking care to associate them to the right categories and wallets. We advise you to record your expenses as and when they are made during the day. The AlphaManager interface allows you to record an expense in less than 15 seconds. You can wait until the end of the day but you may forget your spending or have lots to record.

You may find this tedious at first but very quickly it will become natural and even a reflex. Your brain will also quickly learn to hold back the amounts while you save them.

To record an expense or income you can use the red floating button at the bottom right of the home page. It allows you to open the interface for entering transactions (expenditure or income). You can also use the side menu and take "Add an expense" or "Add a money entrance"

What are the transfers for :

Money transfers are used to materialize taking money in one of your wallets and put it in another.

For example, when you withdraw money from your bank account, you must register it in AlphaManager like transferring money from your account to your wallet (the money you have on you).

They are not considered as expenses.

Identify your expenses with AlphaManager :

We recommend that you use AlphaManager for at least 3 months without trying to control your spending. So you will have a real picture of your financial habits.

You can then easily identify your expense categories. To do this, simply go to "Evolution" in the side menu and take the state "Expenses by categories".

This graph shows you the categories where you spend your money the most. You can touch on a bar to have more details: the total amount, the number of operations and a button allowing you to see all operations in this category.

You can change the period: today, this week, this month, this year and personalized allows you to choose the observation period yourself.

You can also observe the evolution of the expenses of a category over several months. This will allow you to easily determine the appropriate amount for the budget.

To do this, simply go to "Evolution" in the side menu and take the state "Expenses's evolution".

This graph shows you the evolution of your expenses over a period. You can choose to observe for a category and even for a wallet.

After identifying your biggest expense categories you can move on to the next phase: set budgets and try to stick to them.

Define your budgets :

Before you begin, be aware that your budgets must be achievable and realistic . Do define not too tight a budget.

If you want to reduce your expenses in a category, start by defining a budget which is not too much below of what you usually spend.

Over the months, you can gradually decrease this budget until you reach the appropriate amount.

Remember that your overall budget should be less than your income. You must clear at least 15% to 20% for your savings. The ideal according to us being is to be able to free 50% of its income for the savings.

To define the budget for a category, Go to "Categories" in the side menu, search for the category (the magnifying glass at the top right or 3 points at the top right). Edit the category by touching the 3 dots to the right of the category and taking edit. You can then enter the budget and choose its frequency.

Track your budgets :

To follow your budgets, go to "Evolution" in the side menu and take "Budget tracking" . You will thus have a state which presents the evolution of each category in relation to its budget: the category, the defined budget, the amount spent and the rate of use of the budget. A link allows you to see all the operations in this category.

If you don't want to track a budget by category but rather on overall monthly spending, AlphaManager allows you to do that. Still in evolution, go to "Tracking monthly budgets" . You can set a monthly budget per month and see the status of expenses against this budget. The monthly budget that you define is automatically renewed the following month. You can turn this off. You can also change the budget at any time.

As soon as you respect your budgets, you will start to generate savings. We will now see how to follow the evolution of your savings

Track your savings :

To effectively monitor your savings, you must have one or more wallets dedicated solely to your savings.

You must then tell AlphaManager what are these wallets. To do this, go to "Your wallets" in the side menu, look for the wallet (the magnifying glass at the top right or 3 points at the top right). On the wallet touch the 3 points right and take "Set for Savings". This will tell AlphaManager that this wallet contains your savings.

You will need to do this for all of the wallets that contain your savings.

To effectively monitor your savings, go to "Evolution" in the side menu and take "Your wallets's evolution" . Choose the granularity that suits you and check on "savings wallet only" . We advise you to choose as criteria : year, month by month and all wallets. You will have a curve which shows you the evolution of your current savings of the year.

2019-2020 © alpha041